Are you a responsible Investor?

Written by R. A. Stewart

Answer these three questions to find out, but be honest.

Question number 1:

Do you blame others for losses which may or may not have been out of your control?

If you had money invested in a company which went into liquidation, do you take responsibility for the loss and learn lessons from it or do you find a scapegoat and play the blame game by finger pointing at others. Several finance companies went under in New Zealand during the Global Financial Crisis of 2007/2008 and there were sad stories of investors who had their life savings invested in the one company. In other words they had placed all of their eggs in the one basket. If they were honest, these people would have admitted that they were greedy because these companies were paying investors higher than normal interest rates. Financial experts were saying prior to these meltdowns that the higher interest rates do not reflect the risk investors are taking.

Question number 2:

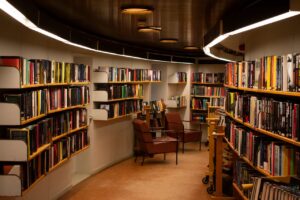

Do you improve your financial literacy by reading finance and investing books?

Unless you educate yourself in matters of finance and investing you will be at the mercy of sharks who will take advantage of your ignorance. Sad stories appear in the newspapers now and again of people losing money because of some financial mistake. If they had sufficient financial literacy they would have made different decisions. The ability to discern whether something is right or wrong is sometimes down to education and experience.

Question number 3:

Do you save something from every payday to invest?

It is not how much you make which counts, it is what you manage to save from every payday.

Financial experts say that you should save at least 10% of your income for the purpose of building your wealth. In this day and age there is no shortage of investment opportunities and it only takes $14 or so to start a share portfolio.

Question number 4:

Do you make your own investing decisions?

Some people like to leave all of the decision making to others. Why?

Because they want someone else to blame if everything turns to custard and losses will occur. It is all very well asking a financial adviser where you should invest your money but investors need to take responsibility for their own decisions and use their common sense.

Fund managers make decisions on investors behalf but as an investor it is your choice of whether to invest in growth, balanced, or conservative funds, and that all depends on your time frame.

A mature person admits their mistakes and treats them as a learning experience and uses the lessons learned in order to make better decisions in the future.

About this article

You may use this article as content for your blog/website, or ebook. Feel free to share this article on social media.

Read my other articles on www.robertastewart.com